pay indiana property taxes online

Payments must be postmarked by the due date in order to be considered on time and avoid penalties. See Results in Minutes.

Featured Free Book Book Is Free From 07 08 2019 Until 07 12 2019 If The Dates Are The Same Book Is Free On Financial Freedom Promote Book Free Book Promotion

Property Tax Installment Due Dates are May 10 and November 10.

. How Do I Pay My Indiana Property Taxes. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. If requesting a receipt please include a self-addressed stamped envelope.

E-Check Visa Mastercard Discover and American Express accepted. ECheck no service fee. The Property Tax Portal will assist you in finding the most frequently requested information about your property taxes.

The fee for a credit card payment is 295 with a min fee of 100 and the fee for an e-check is 95. Elkhart County is excited to offer residents an easy and convenient method to view and pay their real estate personal property and mobile home tax bills online. In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes Indiana Code 6-6-65.

If those dates fall on a weekend or holiday payments are due on the next business day. Choose from the options below. Taxes not paid on or before the due date are subject to penalty.

The treasurer settles with township and city treasurers for taxes collected for the county and state. Pay my tax bill in installments. Claim a gambling loss on my Indiana return.

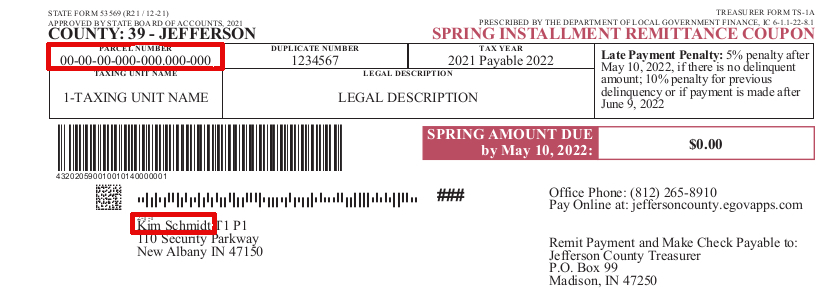

Room 109 Anderson IN 46016 765 641-9645 Madison County Treasurers Office 16 E 9th St. MAY 10 2022 SPRING INSTALLMENT DUE AND NOVEMBER 10 2022 FALL INSTALLMENT DUE. 877690-3729 Jurisdiction Code 2490.

Have more time to file my taxes and I think I will owe the Department. Know when I will receive my tax refund. Building A 2nd Floor 2293 N.

The Marion County Assessors Office locates identifies and appraises all taxable property accurately uniformly and equitably in accordance with Indiana law. The County Treasurer is the property tax collector and custodian of all monies with responsibility for investing idle funds and maintaining an adequate cash flow. Know when I will receive my tax refund.

YOU MUST HAVE. To pay your bill by mail please send your payment to. 100 W Main St OR.

The official website of Delaware County Indiana. The Indiana Department of Revenue does not handle property taxes. Use 18 Digit Parcel Number Example.

Claim a gambling loss on my Indiana return. Pay Property Taxes Online. 183335552227774003 Numbers Only Please use only 1 Search Option at a time.

You will need your amount and your credit card information. Pay my tax bill in installments. Pay with a Credit Card.

Tax bills are only sent out once a year for payment of both installments of your taxes. You can pay your property tax over the phone by calling 317327. Find Indiana tax forms.

800AM400PM Saturday Sunday Legal Holidays. Pay your real estate property taxes online or pay by phone at 877-571-1788 Visit the Treasurers Office home page. Tax bills are set to be mailed out Friday April 14 2022.

Mail to office. Disclaimer Madison County Treasurers Office 16 E 9th St. Use Address Example.

Pay your full property tax bill via a participating bank. Find Indiana tax forms. This is a fee based service.

Use First Name Last Name Example. You may pay real personal and mobile home tax online. Tax bills are mailed once a year.

Have more time to file my taxes and I think I will owe the Department. Barbara Hackman Bartholomew County Treasurer. Room 109 Anderson IN 46016 765 641-9645.

South Bend IN 46634-4758. Johnson County Treasurer 86 W. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Property with a total tax bill of 2500 or less will be billed the total due on the 1st installment. Credit Card 25 per transaction 150 minimum. Both the 1st and 2nd installment tax bill payment stubs are included.

Please direct all questions and form requests to the above agency. 111 North 7th Street Vincennes Indiana 47591. Court Street Franklin IN 46131 include tax coupon with payment PAY BY PHONE.

Look Up Any Address in Indiana for a Records Report. Take the renters deduction. This tax payment and escrow system will allows mortgage escrow and title companies to create a portfolio of properties for which you are responsible to pay property taxes and make one electronic payment to cover all taxes due for your portfolio.

Visa American Express Discover and MasterCard. E-checks will incur a convenience fee of 150 per transaction. 4TAX 4829 or 1888 You can pay your property tax by mail.

Convenience fees are collected by the processing company not Vigo County. Ad Public Indiana Property Records Can Reveal Mortgages Taxes Liens and Much More. Indianapolis Marion County Payment Portal.

Take the renters deduction. There is a 395 or minimum convenience fee for this service that is retained by Paygov. You will need to have information on the parcel you are paying.

FirstNameJohn and LastName Doe OR. Visa debit cards are charged a flat rate of 395. Due dates are on each installment statement.

You may pay your taxes by CreditDebit CardACH Check online at Paygov by phoning 1-866-480-8552. Credit card services are provided by Forte. The treasurer collects real personal and mobile home.

Main Street Crown Point IN 46307 Phone. Please put the address of your tax payment in the box provided. Credit and debit card transactions will incur a convenience fee of 235 of your total tax liability.

2022 Primary Election DEPARTMENT PHONE LIST Employment Opportunities Pay Traffic Citation Pay Court Fines and Fees Warrant Search Court Date Lookup Pay Property Tax Online Property Tax Information Emergency Alerts and Public Notices System Problem Solving Courts File Homestead and Mortgage Deductions Online Update Tax Billing Mailing Address. There is a 24 fee for Credit Card payments with a minimum charge of 175. Debit Card 395 per transaction.

Memory Jogger List Template Why It Is Not The Best Time For Memory Jogger List Template List Template Memories Templates

Fafsa Checklist Fafsa Checklist Create Yourself

Pennsylvania Loses Usd 424 In Tax Revenue From Casinos Shutdown Casino Pennsylvania Online Casino

Dor Owe State Taxes Here Are Your Payment Options

Sample Maps For Iowa Blue Shadowy Map Map Maker Iowa

Amazon Com Monopoly Board Game Toys Games Monopoly Game Monopoly Board Monopoly Cards

Kasuti Of Karnatak Indira Joshi 1963 Textiles Folk Art Folk Art Folk Folk Embroidery

Fun Insurance Game Student Activity Or Test Review In 2022 Financial Literacy Lessons Student Activities Life Skills Lessons

Family And Consumer Sciences At The Middle School Level Prepares Students To Begin Their Family And Consumer Science Science Lesson Plans Life Skills Classroom

Pros And Cons Of Using A Home Equity Loan To Fund College Mortgage Tips Reverse Mortgage Homeowner Taxes

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Ricevimenti Valutazione

Treasurer Johnson County Indiana

6 Most Cost Effective Ways To Spend Your Tax Refund On Your Home Tax Refund Tax Deductions Insurance Premium